Wholesale Electricity Prices in 2021

The electric wholesale market price spikes

Wholesale Electricity Prices in 2021

Navigating the electric wholesale market for electricity can be a bit confusing at times. There are many varying factors that affect energy resources and distribution, so being able to gauge the market takes years of practice or requires continuous energy consultation. Here are a few facts, tips, and notes to take, in order to understand the basics of wholesale electricity.

What is Wholesale Electricity?

Wholesale electricity costs are paid for by market participants that purchase electricity from the wholesale market, for either their own use or because they are a supplier to retail consumers. In particular, prices from the short-term wholesale markets are very different from the fixed prices that supplier services are able to provide to residential consumers, which tend to be fixed over a longer period of time.

Factors That Increase Wholesale Electricity Costs

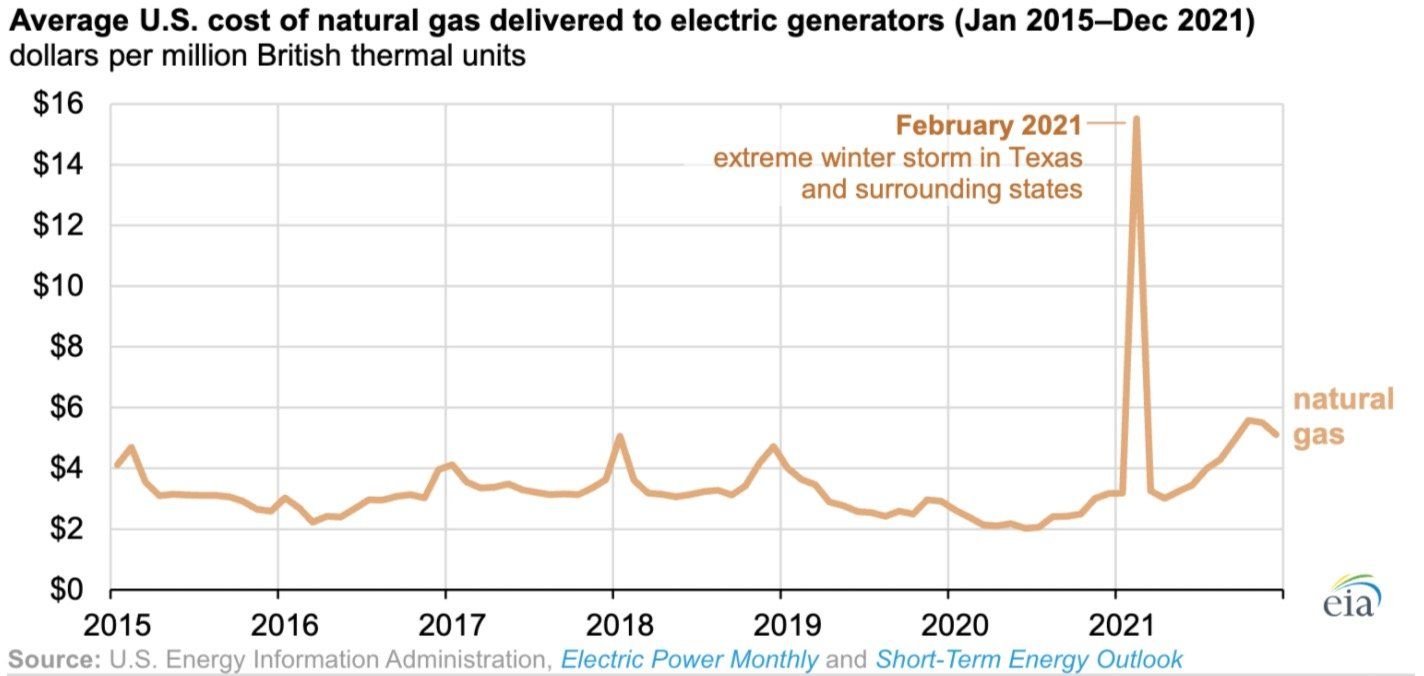

WEATHER: At the start of February 2021, Texas experienced an energy crisis that had not been seen in decades. The Electric Reliability Council of Texas (ERCOT) took a major hit to the power infrastructure, as a massive Polar Vortex crippled the state with extensive power outages and distribution interruptions. According to the U.S. Energy Information Administration, "Between February 14 and February 19, hourly wholesale prices per MWh at the ERCOT North trading hub exceeded $6,000 per megawatt-hour (MWh) 70% of the time. For the month of February, the Texas wholesale electricity price averaged $1,485/MWh." The cold weather that started in Texas continued through the entire central U.S. This ended up with the cost of natural gas delivered to electric generators averaging $2.40 per million British thermal units (MMBtu) in 2020, and more than doubled by the time quarter 4 ended in 2021 to $5.04/MMBtu.

POWER PLANTS COSTS:

Power plant costs can be affected by weather as well, which can have a positive or negative affect on wholesale electric prices. Power plants also have financing, construction, maintenance, and operating costs that may vary each year.

FUEL COSTS: Fuel prices may increase during periods of high electricity demand and when there are disruptions in fuel supply. This can be a result of extreme weather events and even transportation and delivery infrastructure issues. The higher the fuel price, the more it costs to generate electricity.

Overall, the cost spike of 2021 resulted in rising costs for natural gas across the U.S. While there has been some decline at the start of 2022, it's hard to tell if the natural gas market will ever be what it was prior to 2021. Another circumstance that will most likely become a major determining factor are U.S. LNG exports continuing to grow in demand for Europe and Asia, and profit margins for those LNG exports increasing at an unprecedented rate.

You can find out more about the recent news of U.S. LNG exports here.