What is Backwardation?

Understanding Backwardation

Normally we use terms like spot price to describe the contract of buying or selling a commodity, security or currency for an immediate settlement.

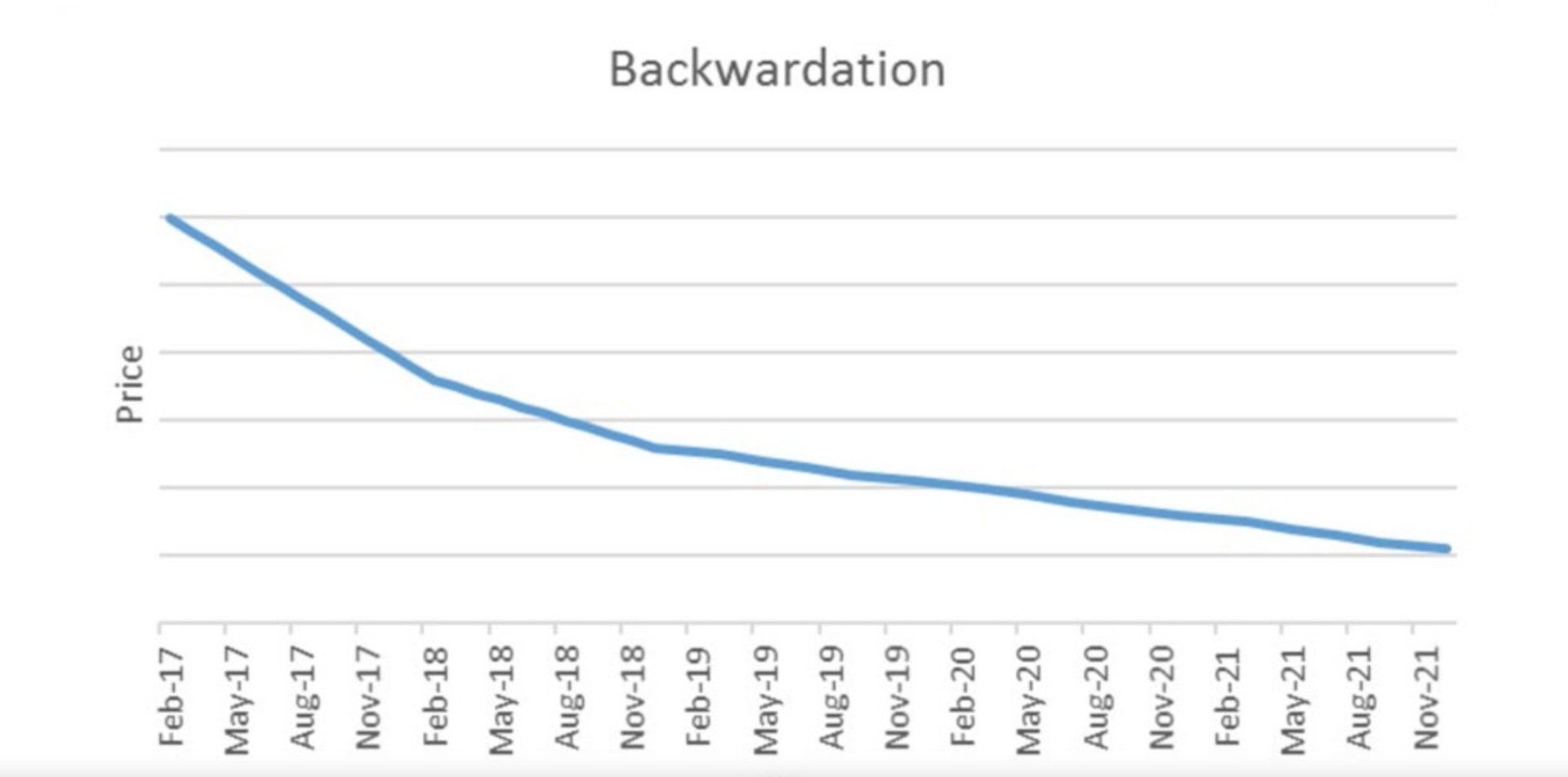

However, sometimes futures prices will be lower than the current day’s spot price, meaning the current price may be too high and the spot price may begin to fall in the future. This is an example of backwardation.

In this example, where futures contracts may be lower than the current spot price, traders will often try to sell their assets short at their spot price and then buy futures contracts for a profit. Typically this is a major signal that the current market prices are too high.

In the chart below, the spot price is above the future price which generates a downward sloping curve, which is an example of backwardation.

When it comes to natural gas futures, the main cause of backwardation is a shortage in the spot market.

Backwardation vs. Contango

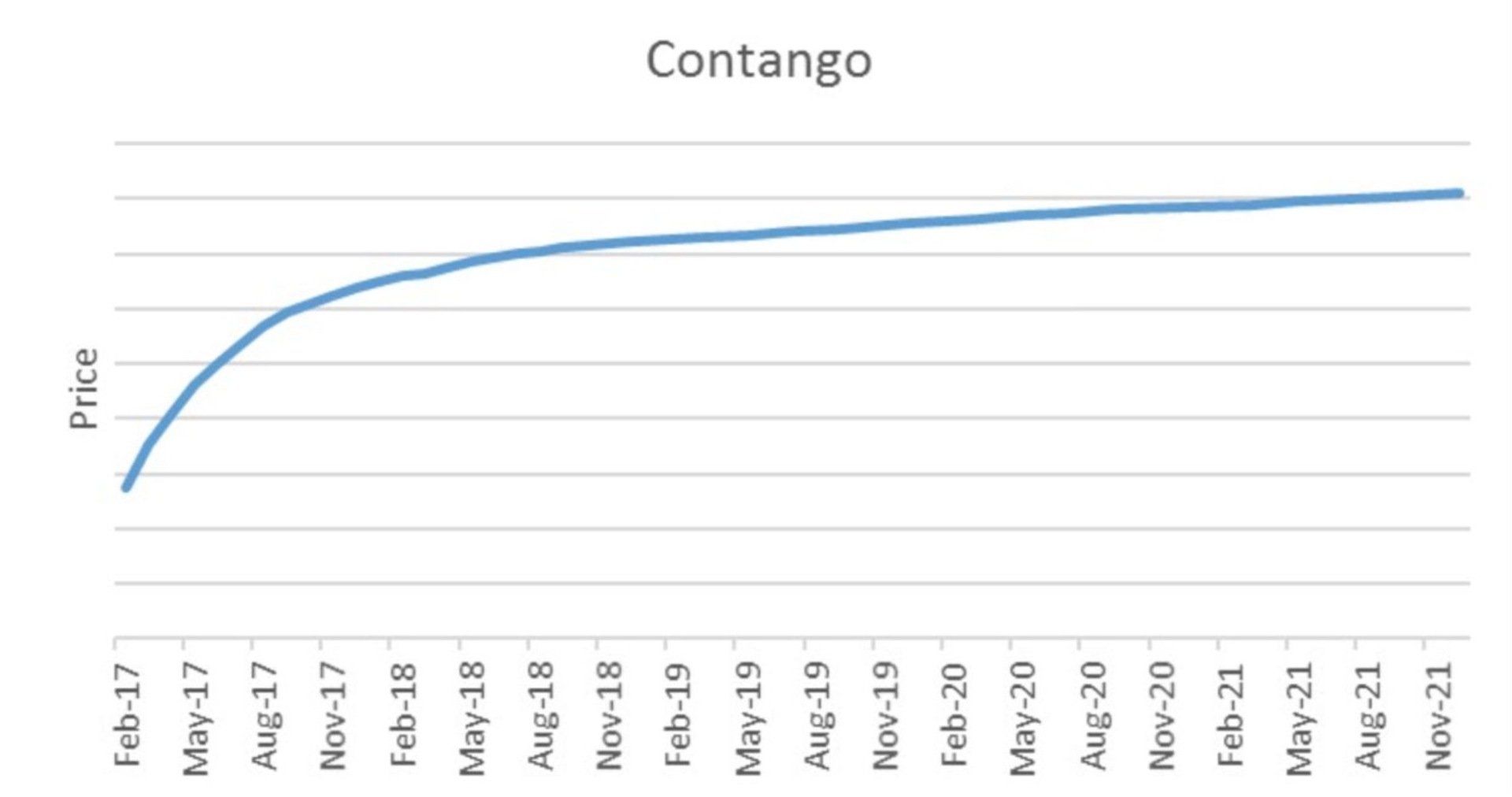

Now that we’ve defined what a downward sloping forward curve means, what does it mean when you see an upward sloping forward curve?

This opposite curve is called contango, which means the spot price is lower than the futures price.

A futures market can shift between contango and backwardation and remain in either state for a short or extended period.